TAKING ALL I'VE READ AND WHAT HISTORY HAS TAUGHT THE WISE, HERE ARE A DOZEN SURE SIGNS THAT WE NEED TO BE PREPARED.... FOR WHEN THE AMERICAN FINANCIAL SYSTEM GOES TO HELL IN A HANDBASKET.

IN NO PARTICULAR ORDER, BUT MATCHING SOME TO WHAT WE SAW JUST PRIOR TO THE ECONOMIC CATASTROPHE OF 2007-2008, AND BELIEVING THAT, PERHAPS, #12 ON THE LIST SHOULD BE #1...

1~ OIL.

"Must have the PRECIOUS!"

Wall Street has been whining ever since the price of oil dropped and gasoline fell to under $3.00 a gallon.

This past Tuesday (12/01/2015) oil dropped to below $40 per barrel, JUST AS IT DID DURING THE BUSH2 REIGN.

The Wall Street Journal (WSJ) seemed to try to assuage fears by reminding us that oil dropped this low back in August, but also subtly mentioned our American stockpile might be partially to blame.

That WSJ offered TWO articles in the same day seemed over-much.

'Quartz', to me, did a far better piece, reporting that this is only the 2nd time since 2008 that oil has dropped this low and giving some nice charts.

See that <here>.

Will OPEC buck the House of Saud and raise the price on crude?

Not if the Saudi monarchy has not determined it has broken Russia, as we saw in the post <HERE>.

The Chicago Tribune opined...

"Instead, OPEC output may go UP. Sanctions on Iranian oil sales are about to end, Indonesia is about to be reinstated as a member and Iraq's production is coming back strongly after years of conflict."

So, despite the howl from old Wall Street, oil and ,therefore, gas prices SHOULD hold on the lower end or drop still lower.

2~ CORPORATE DEBT DEFAULTS.

CORPORATE DEBT IS SKY-HIGH AND, SINCE THEY KNOW THEY CAN GET BY DOING SO, CORPORATIONS ARE DEFAULTING.

Peter Schiff has been crying collapse almost all year and mentions this corporate debt default.

Since many don't set much stock in Schiff's take, let's go to WSJ, which foolish Americans seem to count on for...ummm.."facts"???

"Credit-rating firms are downgrading more U.S. companies than at any other time since financial crisis.

Falling profits and increased borrowing at U.S. companies are rattling debt markets, a sign the six-year-long economic recovery could be under threat.

Credit-rating firms are downgrading more U.S. companies than at any other time since the financial crisis, and measures of debt relative to cash flow are rising. Analysts expect profits at large companies to decline for a second straight quarter for the first time since 2009.

In August and September, Moody’s Investors Service issued 108 credit-rating downgrades for U.S. nonfinancial companies, compared with just 40 upgrades. That’s the most downgrades in a two-month period since May and June 2009, the tail end of the last U.S. recession."

THE SAME THING HAPPENED WHEN WE TANKED BEFORE.

"U.S. companies have increased borrowing to levels exceeding those just before the financial crisis, as firms pursue big acquisitions and seek to boost stock prices by buying back shares. According to one metric, the ratio of debt to earnings before interest, taxes, depreciation and amortization for companies that carry investment-grade ratings, meaning triple-B-minus or above, was 2.29 times in the second quarter. That’s higher than the 1.91 times in June 2007, just before the crisis, according to figures from Morgan Stanley."

Actually, reports say consumer credit card purchases were the lowest since 1990.

"Combined outstanding debt on all types of credit cards in the U.S. of $881.57 billion at year-end 2014 was the lowest level as a percent of total consumer credit since 1990."

"Shock and awe" as Americans save more, spend less, use more debit cards than credit cards.

MANY websites are pointing to this happening before the crash in 2007-2008.

But, again, let us plod over to Ye Olde WSJ for a peek at the whine we found there in November.

"Slow U.S. Consumer Spending Signals Caution"

"Confidence index slips in November as businesses struggle to pin down what is driving spending patterns

The latest evidence: Americans last month socked away much of their income from rising wages, pushing the personal saving rate to its highest level in nearly three years.

“Consumers have the wherewithal to spend, they just don’t want to,” Michelle Girard, an economist at RBS Securities, said in a note to clients.

"“It appears as though many consumers are angry,” Ms. Cochran said. “They all seem to be—not necessarily at the same thing. Lots of concern about global issues, concern about layoffs and so on. So I would say that right now the consumer is a mystery.”

AMERICANS SAVING?AMERICANS ANGRY?

"OH, NOOOO!" SCREAMS WALL STREET.

NOTE TO WALL STREET: STOP SCREWING AMERICANS AND SEE IF THAT HELPS?

4~ FORECAST FOR BUSINESS INVESTMENTS WAY DOWN.

SOME SAY IT'S "ANEMIC".

BLAME THE TAX CODE, THOUGH MOST CORPORATIONS DAMNED WELL FIND LOOPHOLES FOR THAT AND SOME OF THE BIGGEST COMPANIES GET BY PAYING NO TAXES!

[Also see <THIS>, a chart of tax-dodging companies.]

AWWW, REALLY?

JUST SEND ANOTHER MILLION JOBS TO CHINA WHILE YOU'RE AT IT, MAYBE?

BUSINESSES RUN CHEAPLY THERE, RIGHT?

AND THE FEDERAL GOVERNMENT, WITH TAXPAYER MONEY, SUBSIDIZES YOUR MOVE ABROAD!

A REAL WIN-WIN SITUATION, EH, LIARS?

SOME SAY IT'S "ANEMIC".

"...right now, the Business Roundtable's forecast for business investment in 2016 is anemic. It's the lowest since 2009 when the U.S. was still in the Great Recession."

"To see that sharp decline in capital investing is alarming," says Randall Stephenson, CEO of AT&T (T, Tech30) and chair of the Business Roundtable. "Investment drives hiring. It drives productivity and wage growth."

BLAME THE TAX CODE, THOUGH MOST CORPORATIONS DAMNED WELL FIND LOOPHOLES FOR THAT AND SOME OF THE BIGGEST COMPANIES GET BY PAYING NO TAXES!

[Also see <THIS>, a chart of tax-dodging companies.]

"Stephenson

calls the U.S. tax code "uncompetitive" and says more businesses are likely to flee the U.S. to cheaper tax locales in Europe or elsewhere if Congress doesn't act. "

[YOU CAN COUNT ON THE BROTHEL ON CAPITOL HILL, BOYS, THEY'LL FIX THIS IF THEY HAVE TO KILL THEIR GRANDMAS TO DO SO!]

The big American drug company Pfizer (PFE) just announced a mammoth deal to buy Ireland-based Allergan, which was partly driven by plans to move the company's headquarters overseas and take advantage of lower taxes.

JUST SEND ANOTHER MILLION JOBS TO CHINA WHILE YOU'RE AT IT, MAYBE?

BUSINESSES RUN CHEAPLY THERE, RIGHT?

AND THE FEDERAL GOVERNMENT, WITH TAXPAYER MONEY, SUBSIDIZES YOUR MOVE ABROAD!

A REAL WIN-WIN SITUATION, EH, LIARS?

WHO NEEDS INVESTMENTS IN AMERICA WHEN A FEW DOLLARS A DAY OR SO FOR A WORKER IN CHINA IS COMPARED TO AMERICAN MINIMUM WAGE, RIGHT?

NO, DON'T INVEST IN AMERICA...GO FOR BIGGER PROFITS OVERSEAS.

CONTINUE TO FIGHT A DECENT WAGE FOR AMERICANS AND SEE WHAT HAPPENS.

USE AMERICAN TAXPAYER MONEY TO BAIL YOURSELVES OUT OF BINDS, TAKE BILLIONS FROM THE FED FOR YOUR STUPID BLUNDERS, YOUR BAD BUSINESS DECISIONS, YOUR UNDERHANDED DIRTY DEALINGS.

JUST KEEP SHOWING AMERICAN WORKERS AND TAXPAYERS THAT THEY REALLY DON'T MATTER.

ANYWAY, THE BIG CORPORATIONS EXHIBITED THE SAME BEHAVIOR BEFORE THE LAST CRASH.

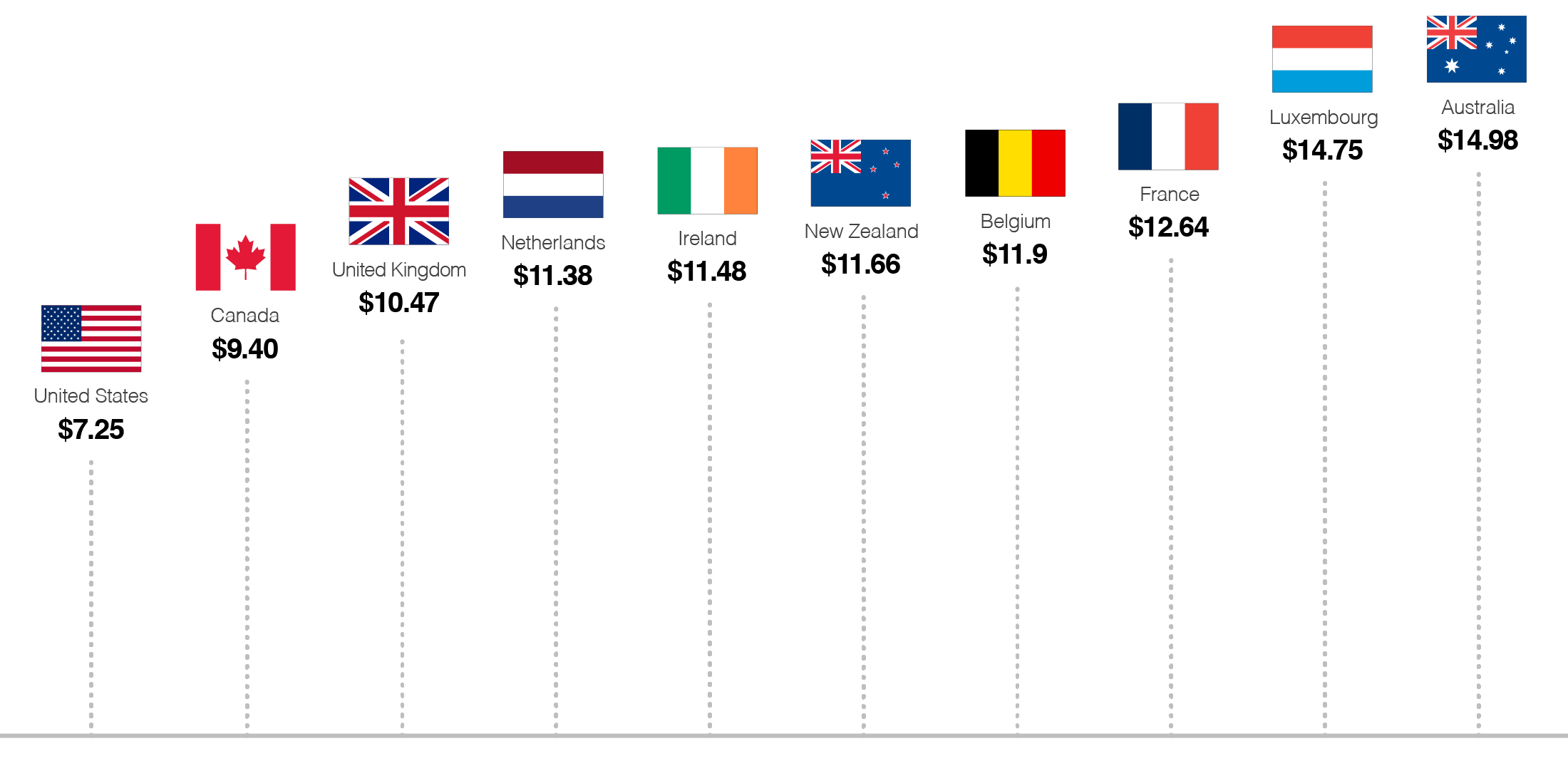

HERE'S A LOOK AT THE NATIONS YOU CAN BET WALL STREET BIG NAMES WILL NOT BE MOVING TO, NATIONS WITH A BETTER MINIMUM WAGE THAN AMERICA, AND THIS IS A SHORT LIST:

USE AMERICAN TAXPAYER MONEY TO BAIL YOURSELVES OUT OF BINDS, TAKE BILLIONS FROM THE FED FOR YOUR STUPID BLUNDERS, YOUR BAD BUSINESS DECISIONS, YOUR UNDERHANDED DIRTY DEALINGS.

JUST KEEP SHOWING AMERICAN WORKERS AND TAXPAYERS THAT THEY REALLY DON'T MATTER.

ANYWAY, THE BIG CORPORATIONS EXHIBITED THE SAME BEHAVIOR BEFORE THE LAST CRASH.

HERE'S A LOOK AT THE NATIONS YOU CAN BET WALL STREET BIG NAMES WILL NOT BE MOVING TO, NATIONS WITH A BETTER MINIMUM WAGE THAN AMERICA, AND THIS IS A SHORT LIST:

5~ BLOOMBERG'S "ECONOMIC SURPRISE" INDEX LOWER THAN AT ANY POINT IN THE LAST "RECESSION".

"To say that this year has been a bit of an outlier for economic disappointment in the 15 year history of the series is a bit of an understatement.

While it's worth stressing that the chart represents the data surprise relative to forecast, not the actual growth trend, it's really quite remarkable that an institution that keeps paying lip service to "the data" is finally preparing to hike when said data has disappointed expectations for the better part of a year straight.

"

THE SUDDENNESS OF THE DIP WAS QUITE A "SURPRISE", RIGHT?

6~ CONTRACTION OF U.S. MANUFACTURING

"U.S. MANUFACTURING TUMBLES TOWARD RECESSION"

Reported in Fiscal Times AND old WSJ, it's apparently just a ho-hum fact, Jack... to SOME, but not at all a "so what?" revelation for many of us.

"U.S.

Reported in Fiscal Times AND old WSJ, it's apparently just a ho-hum fact, Jack... to SOME, but not at all a "so what?" revelation for many of us.

"U.S.

manufacturing just had its worst month since the Great Recession.

The Institute for Supply Management’s Purchasing Manager’s Index, a monthly gauge of factory activity, fell from 50.1 in October to 48.6 last month. A reading below 50 indicates manufacturing activity is contracting, and this is the first time that’s happened since November 2012.

It’s also the weakest reading since June 2009."

It’s also the weakest reading since June 2009."

7~ RAPID FLATTENING OF U.S. BOND YIELD

A Reuters article on Dec. 2 discussed the fact that Citigroup analysts are projecting that there is a 65 percent chance that the U.S. economy will plunge into recession in 2016…

"The outlook for the global economy next year is darkening, with a U.S. recession and China becoming the first major emerging market to slash interest rates to zero both potential scenarios, according to Citi.

As the U.S. economy enters its seventh year of expansion following the 2008-09 crisis, the probability of recession will reach 65 percent, Citi’s rates strategists wrote in their 2016 outlook published late on Tuesday.

A rapid flattening of the bond yield curve towards inversion would be an key warning sign.

"The cumulative probability of U.S. recession reaches 65 percent next year," Citi's rates strategists wrote in their 2016 outlook published late on Tuesday. "Curve inversion will likely come more quickly than the consensus thinks."

8~ THE "VELOCITY "OF MONEY HAS DROPPED TO ALL-TIME LOW.

NOT EVEN AT THE WORST POINT IN THE PREVIOUS RECESSION WAS IT THIS LOW.

When economic conditions start to get tough, people start to hold on to their money. That means that money doesn’t change hands as quickly and the velocity of money goes down.

As you can see below, the velocity of money has declined during every single recession since 1960…

As you can see below, the velocity of money has declined during every single recession since 1960…

AND WE CAN DEFINITELY SEE WHERE WE STAND NOW.

9~ BLOOMBERG COMMODITY INDEX HIT 16-YEAR LOW LAST MONTH.

In 2008, commodity prices crashed just before the stock market did.

"A big catalyst for the ongoing collapse in the Bloomberg commodity index which just hit a fresh 16 year low, is the relentless surge in the dollar, with the DXY rising as high as 99.98 the highest since April, as a result of rising prospects for a December U.S. rate hike (odds are now at 70%, up from 36% a month ago) boosting currency differentials and flows into the USD, making commodities more expensive for buyers in other currencies. "

LET'S HEAR IT FOR THE COMING RATE HIKE, RIGHT?

ONLY FOR WALL STREET WILL THAT BE, IN THE LONG RUN, GOOD NEWS.

In 2008, commodity prices crashed just before the stock market did.

"A big catalyst for the ongoing collapse in the Bloomberg commodity index which just hit a fresh 16 year low, is the relentless surge in the dollar, with the DXY rising as high as 99.98 the highest since April, as a result of rising prospects for a December U.S. rate hike (odds are now at 70%, up from 36% a month ago) boosting currency differentials and flows into the USD, making commodities more expensive for buyers in other currencies. "

LET'S HEAR IT FOR THE COMING RATE HIKE, RIGHT?

ONLY FOR WALL STREET WILL THAT BE, IN THE LONG RUN, GOOD NEWS.

10~ COPPER.

The price of copper has plunged all the way down to $2.04.

The last time it was this low was just before the stock market crash of 2008.

MANY ARE POINTING TO JUST COPPER PRICES AS AN ECONOMIC INDICATOR, AND IT IS, BUT IT ISN'T "JUST" COPPER...IT'S ALL METALS.

"As Bloomberg also notes, a London Metal Exchange Index of six industrial metals has fallen for six weeks. Gold has dropped for five straight weeks, crude oil is on a three-week losing run. The Bloomberg Commodity Index is set for its worst year since the financial crisis, plunging 23 percent."

"As Bloomberg also notes, a London Metal Exchange Index of six industrial metals has fallen for six weeks. Gold has dropped for five straight weeks, crude oil is on a three-week losing run. The Bloomberg Commodity Index is set for its worst year since the financial crisis, plunging 23 percent."

NASDAQ's TAKE ON COPPER <HERE>.

11~ "JUNK" BONDS ARE PLUMMETING.

FOR MORE THAN YOU MAY HAVE WANTED TO KNOW ABOUT "JUNK BONDS", READ <HERE>.

12~ AMERICA KEEPS MEDDLING IN THE AFFAIRS OF OTHER NATIONS.

THAT HAS BEEN CRASHING OUR ECONOMY SINCE ABOUT 1950.

11~ "JUNK" BONDS ARE PLUMMETING.

Looking back at 2008, we see that junk bonds totally tanked.

Why is this important?

Why is this important?

Because junk bonds started crashing BEFORE stocks did last time, and right now they have dropped to the lowest point that they have been since the last "financial crisis".

A reason for this is that Junk Bond Holders are low on the list of creditors who can expect to be paid off in the event of corporate default, hence the name. They yield more because they carry more risk, so when risk threatens to rise or rises, savvy holders want out.

Thus it is interesting to see that Junk Bonds have just fallen to a 3-year low.

This is a leading indicator for the market and it means trouble. "

12~ AMERICA KEEPS MEDDLING IN THE AFFAIRS OF OTHER NATIONS.

THAT HAS BEEN CRASHING OUR ECONOMY SINCE ABOUT 1950.

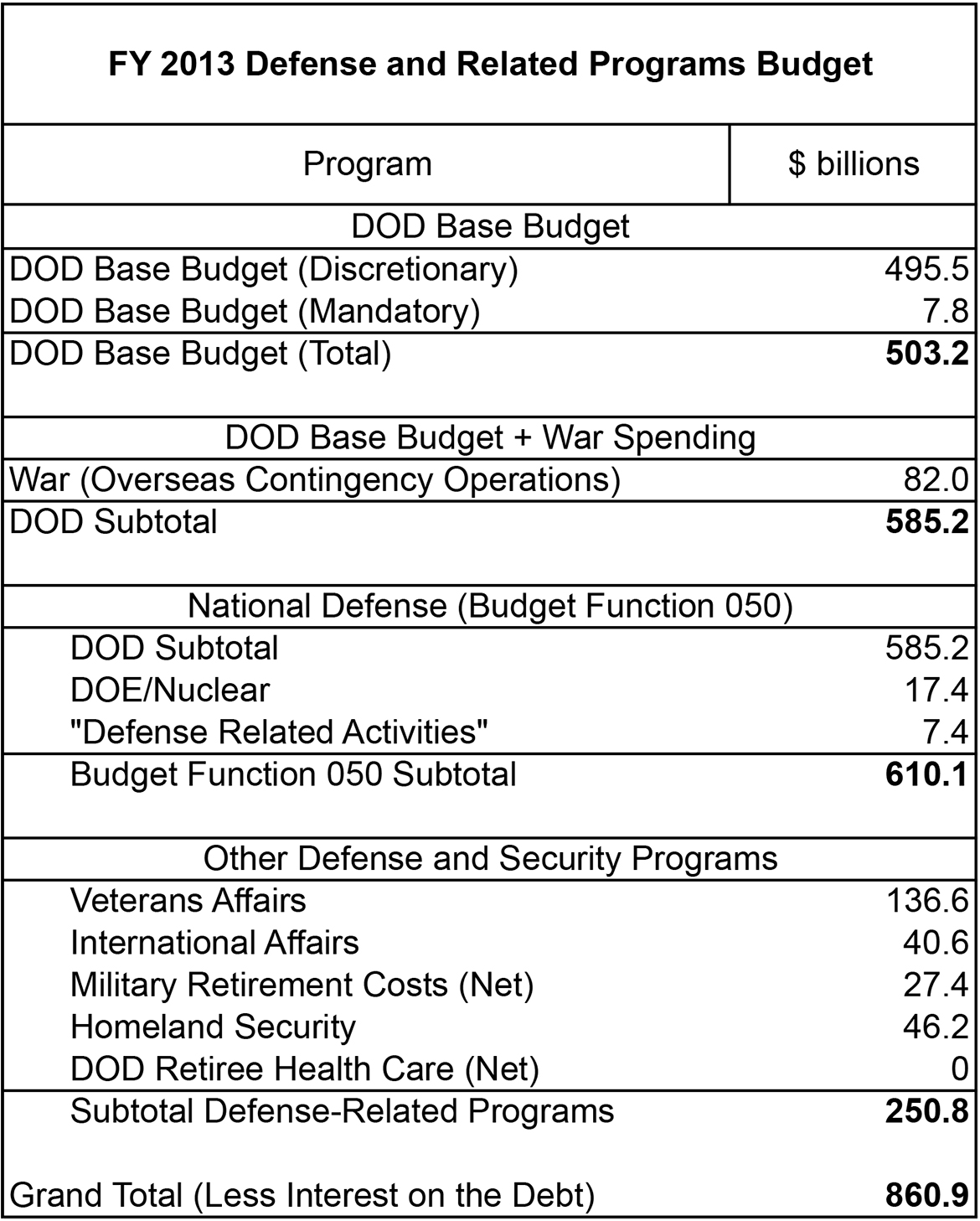

AMERICA'S BIGGEST GLUT OF TAXPAYER MONEY IS FOREIGN WARS, MILITARY SPENDING, WHAT IT TAKES TO KEEP THE WHEELS OF THE MILITARY-INDUSTRIAL COMPLEX GREASED.

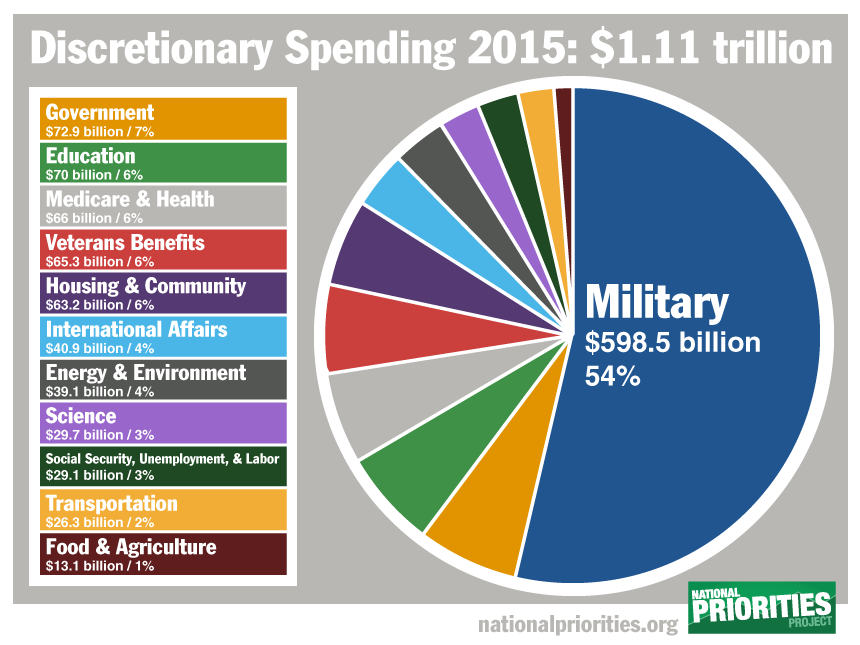

I AM ANGERED EACH TIME MAINSTREAM MEDIA POSTS THOSE PIE CHARTS THAT SHOW OUR MILITARY BUDGET IS UNDER A TRILLION DOLLARS.

THAT'S SIMPLY A LIE!

MILITARY SPENDING, AS TOUTED BY THE "SPIN DOCTORS" DOESN'T EVEN INCLUDE ROUGHLY $30 BILLION FOR RETIRING MILITARY PERSONNEL, DOES NOT INCLUDE THE INTEREST PAID ON THAT "MILITARY BUDGET" (roughly $58 BILLION) , NOR THE FOLLOWING:

~$137 billion to Department of Veterans Affairs to care for wounded or retired military veterans.

ADD JUST THOSE AND HERE'S A TRUER PICTURE OF WHAT WE SPEND:

INSTEAD OF THAT, THE CHART BELOW IS THE USUAL CRAP AMERICANS SEE IN THE PRESS...A PURE LIE.

LOOKING AT THE MILITARY'S EXCEPTIONALLY LARGE BUDGET BASED ON JUST "DISCRETIONARY SPENDING" MAY OFFER YOU A CLUE TO HOW CONGRESS LOVES TO FUND WARS, ETC.

54% OF ALL DISCRETIONARY SPENDING IS SPENT ON THE MILITARY.

I AM ANGERED EACH TIME MAINSTREAM MEDIA POSTS THOSE PIE CHARTS THAT SHOW OUR MILITARY BUDGET IS UNDER A TRILLION DOLLARS.

THAT'S SIMPLY A LIE!

MILITARY SPENDING, AS TOUTED BY THE "SPIN DOCTORS" DOESN'T EVEN INCLUDE ROUGHLY $30 BILLION FOR RETIRING MILITARY PERSONNEL, DOES NOT INCLUDE THE INTEREST PAID ON THAT "MILITARY BUDGET" (roughly $58 BILLION) , NOR THE FOLLOWING:

~$137 billion to Department of Veterans Affairs to care for wounded or retired military veterans.

~$46 billion to Department of Homeland Security for responding to terrorism and natural disasters.

~ $41 billion to International Affairs for additional war funding, weapons training to foreign militaries, and foreign aid.

~ There are nondefense-related items in this amount, such as operating US embassies and consulates and normal diplomatic operations.

However, these are all key components of the US government’s national security apparatus that are not included in that military budget.

However, these are all key components of the US government’s national security apparatus that are not included in that military budget.

ADD JUST THOSE AND HERE'S A TRUER PICTURE OF WHAT WE SPEND:

INSTEAD OF THAT, THE CHART BELOW IS THE USUAL CRAP AMERICANS SEE IN THE PRESS...A PURE LIE.

54% OF ALL DISCRETIONARY SPENDING IS SPENT ON THE MILITARY.

DOING SO IS WHAT KEEPS WALL STREET'S BIGGEST NAMES AFLOAT.

THERE IS A LONG LIST OF COMPANIES WHO LOVE TO PROVIDE WHAT THE PENTAGON WANTS, AND HOW PROFITABLE ARE THOSE GOVERNMENT CONTRACTS?

FOR MORE ON THE DIFFERENCE BETWEEN MANDATORY AND DISCRETIONARY SPENDING BY CONGRESS, GO <HERE>.

THE UNCOUNTED BLACK BUDGET

EVEN THOSE ADDED ITEMS NEGLECT TO MENTION THE "NEWLY DISCOVERED" HIDDEN MILITARY BUDGET, SOME EXTRA FUNDS FOR THE MILITARY-INDUSTRIAL ALLIANCE, NOW TERMED "THE BLACK BUDGET".

THERE IS A LONG LIST OF COMPANIES WHO LOVE TO PROVIDE WHAT THE PENTAGON WANTS, AND HOW PROFITABLE ARE THOSE GOVERNMENT CONTRACTS?

FOR MORE ON THE DIFFERENCE BETWEEN MANDATORY AND DISCRETIONARY SPENDING BY CONGRESS, GO <HERE>.

THE UNCOUNTED BLACK BUDGET

EVEN THOSE ADDED ITEMS NEGLECT TO MENTION THE "NEWLY DISCOVERED" HIDDEN MILITARY BUDGET, SOME EXTRA FUNDS FOR THE MILITARY-INDUSTRIAL ALLIANCE, NOW TERMED "THE BLACK BUDGET".

CONGRESS EVEN PROMISED TO CURB THE "BLACK BUDGET", BUT CONGRESS LIED, AS USUAL.

THIS "BLACK BUDGET" WAS CREATED IN 2002-2005, SO AFTER MORE THAN 10 YEARS, IT'S STILL ALLOWED AND STILL FUNDED!

The Washington Post used the term to describe the Snowden-leaked account of money that funds Central Intelligence Agency, National Security Agency, and other spy service projects, known officially as the National Intelligence Program (NIP).

It can also refer to the Department of Defense’s Military Intelligence Program (MIP). The MIP as we know it was established in 2005 and includes all the intelligence programs that support operations in armed services.

The U.S. military has billions of dollars’ worth of secret projects it doesn’t want you to know about. Too bad—here they are."

THAT WOULD ONLY ADD ANOTHER FEW TRILLION TO THE PENTAGON'S ACTUAL "BUDGET".

NOV. 19, 2013

“$8.5 TRILLION In Taxpayer Money Doled Out By Congress To The Pentagon Since 1996 … Has NEVER Been Accounted For”

“$8.5 TRILLION In Taxpayer Money Doled Out By Congress To The Pentagon Since 1996 … Has NEVER Been Accounted For”

"The Pentagon is the only federal agency that has not complied with a law that requires annual audits of all government departments. That means that the $8.5 trillion in taxpayer money doled out by Congress to the Pentagon since 1996, the first year it was supposed to be audited, has never been accounted for. That sum exceeds the value of China’s economic output last year.

Reuters had to report the same ongoing problem THIS year...MISSING TRILLIONS.

MAYBE "THE DONALD" COULD PUBLISH SOME FACTS ON OUR REAL MILITARY SPENDING?

NO, HE WOULDN'T HAVE THE INTESTINAL FORTITUDE TO DO THAT, NOR WOULD ANY CANDIDATE OUT THERE!

MAYBE OUR WORTHLESS AMERICAN MAINSTREAM MEDIA COULD DIG UP SOME FACTS, MAYBE A FULL DISCLOSURE OF THE ENORMOUS BURDEN ON TAXPAYERS THAT AMERICA'S UNDECLARED WARS AND MILITARY PRESENCE IN VERY ODD PLACES COST US?

NOT IN A MILLION YEARS!

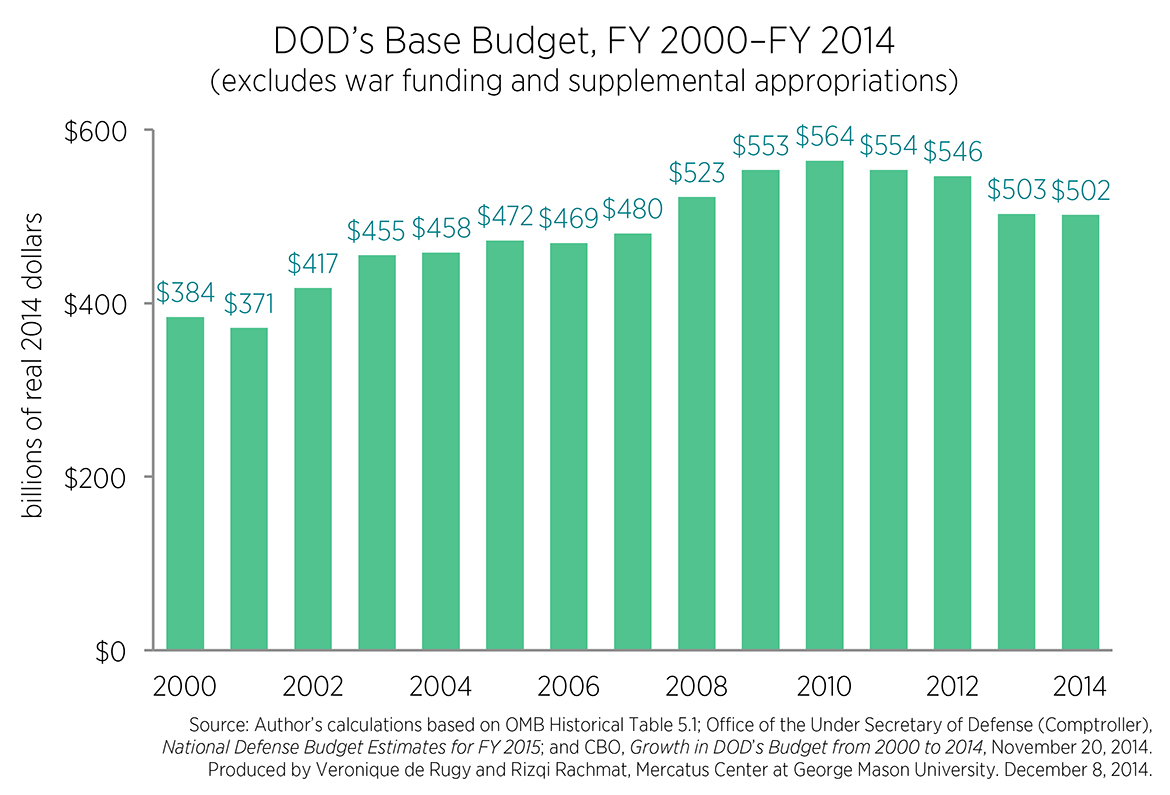

INSTEAD THEY FURTHER THE LIES WITH DISINFORMATION, LIKE OBAMA'S DEEP CUTS TO THE MILITARY BUDGET, SOMETHING EASILY DISPROVED.

MILITARY SPENDING HAS MOST DEFINITELY INCREASED SINCE "THE BIG O" TOOK OFFICE!

MAYBE "THE DONALD" COULD PUBLISH SOME FACTS ON OUR REAL MILITARY SPENDING?

NO, HE WOULDN'T HAVE THE INTESTINAL FORTITUDE TO DO THAT, NOR WOULD ANY CANDIDATE OUT THERE!

MAYBE OUR WORTHLESS AMERICAN MAINSTREAM MEDIA COULD DIG UP SOME FACTS, MAYBE A FULL DISCLOSURE OF THE ENORMOUS BURDEN ON TAXPAYERS THAT AMERICA'S UNDECLARED WARS AND MILITARY PRESENCE IN VERY ODD PLACES COST US?

NOT IN A MILLION YEARS!

INSTEAD THEY FURTHER THE LIES WITH DISINFORMATION, LIKE OBAMA'S DEEP CUTS TO THE MILITARY BUDGET, SOMETHING EASILY DISPROVED.

MILITARY SPENDING HAS MOST DEFINITELY INCREASED SINCE "THE BIG O" TOOK OFFICE!

Present spending matches that of 2006-2007, and outstripped Bush2's spending in 2009, 2010, 2011, and 2012.

WHEN WE FACTOR IN THE ABOVE-MENTIONED ITEMS, WE SEE THAT THE OBAMA ADMINISTRATION'S SPENDING LEAVES BUSH2's IN THE DIRT.

BUT WAIT! THERE'S MORE!

"

Moreover, since 2002, the federal government has folded several programs under “Homeland Security” that are defense expenditures, but not part of the Department of Defense. If we include these other forms of defense spending, we find national defense spending has increased even more than initially thought."

There will be nothing but budget increases over the next two years!

WHY?

BECAUSE THE GOP-CONTROLLED CONGRESS SAID SO, THAT'S WHY!

AS US NEWS REPORTS:

WHY?

BECAUSE THE GOP-CONTROLLED CONGRESS SAID SO, THAT'S WHY!

AS US NEWS REPORTS:

"The measure also sets federal spending through the 2016 and 2017 fiscal years, and EASES STRICT CAPS ON SPENDING by providing an ADDITIONAL $80 BILLION, split evenly between MILITARY and domestic programs.

The Appropriations committees must write legislation to reflect the spending and they face a Dec. 11 deadline to finish the work."

AND WHAT DID THE WHORES ON THE HILL CUT?

AND WHAT DID THE WHORES ON THE HILL CUT?

"The cuts include curbs on MEDICARE payments for outpatient services provided by certain hospitals and an extension of a 2-percentage-point cut in MEDICARE payments to doctors through the end of a 10-year budget.

There's also a drawdown from the Strategic Petroleum Reserve, and savings reaped from a Justice Department FUND FOR CRIME VICTIMS that involves assets seized from criminals."

ONCE AGAIN, CONGRESS ROBS MEDICARE AND AMERICAN CITIZENS TO INCREASE FUNDS FOR THE MILITARY AND "HOMELAND SECURITY".

And aside from all that, we’ve been repeatedly shown that the military wastes and “loses” (cough) trillions of dollars.

See this, this,this, this, this, this, this, this, this, this, this and this.

OR SHOULD WE JUST TALK FOOTBALL?

"ROLL, TIDE!"

IN THE ONGOING GAME OF "LET'S BANKRUPT AMERICA", THE ABOVE 12 SIGNS OF "PISS-POOR MANAGEMENT" ARE BUT THE TIP OF THE PROVERBIAL ICEBERG.

IT'S COMING, AND WE NEED TO REALIZE WE'RE IN FOR IT.

See this, this,this, this, this, this, this, this, this, this, this and this.

OR SHOULD WE JUST TALK FOOTBALL?

"ROLL, TIDE!"

IN THE ONGOING GAME OF "LET'S BANKRUPT AMERICA", THE ABOVE 12 SIGNS OF "PISS-POOR MANAGEMENT" ARE BUT THE TIP OF THE PROVERBIAL ICEBERG.

IT'S COMING, AND WE NEED TO REALIZE WE'RE IN FOR IT.

THANK A CONGRESSMAN, THANK THE FEDERAL RESERVE, THANK THE WORLD BANKING CARTEL, THANK ALL WHO HAVE SHAFTED THIS NATION FOR MORE YEARS THAN I HAVE LIVED.

With only 239 years of existence as a nation, the United States has experienced double the number of crises as Spain, Italy, and Portugal, which are much older societies... 26 FINANCIAL CRISES that took us to the brink of going the way of ROME.

This equates to approximately one crisis every 9 years!

WHY DON'T THE FINANCIAL WIZARDS OF WALL STREET LEARN?

WHY DOESN'T OUR GOVERNMENT LEARN?

WE JUST KEEP GOING DOWN THE SAME OLD TRAIL.

WHY?

MAYBE BECAUSE THE SAME 'BEHIND-THE-SCENES' GROUP OF FINANCIERS HAVE CONTROLLED ECONOMIES FOR CENTURIES?

AND BECAUSE WE ALLOW THAT?

_________________________

OTHER ECONOMIC "NEWS":

~PBS DID AN INTERVIEW (OF SORTS) ON HOW THE FEDERAL RESERVE CREATED THE GREAT DEPRESSION...

READ PARTS OF THE TRANSCRIPT <HERE> (OR PICK YOUR OWN SOURCE WITH A SIMPLE ONLINE SEARCH?).

THE MAN THEY INTERVIEWED EXPLAINED IN UNDER 10 MINUTES HOW THIS WAS ACCOMPLISHED.

THAT man was Milton Friedman, NOBEL PRIZE-WINNING AUTHOR on the history of America's Monetary system.

HERE IS A VIDEO: FROM 30 YEARS AGO... SAME THING GOING ON TODAY.

~ A truly sad article on the Brazilian economic collapse and Goldman Sachs predictions:

<HERE>.

~ HOW BIG BUSINESS CAN SMILE ABOUT GLOBAL RECESSION... <HERE>.

"In the 12 recessions after World War II, the S&P 500 has gone up six times afterwards and down the other six times. The average has been a decline of 3.1 percent, followed by a 12.9 percent increase six months out and 15.3 percent gain a year after, according to figures from Sam Stovall, U.S. equity strategist at S&P Capital IQ."

~ ONE OF THE BEST READS ON THE BLACK BUDGET <HERE>.

~ ONE OF THE BEST READS ON THE BLACK BUDGET <HERE>.

No comments:

Post a Comment